Industry leading

multi-rail,

mobile payments

platform

Industry leading

multi-rail,

mobile payments

platform

![]()

Differentiate with Moli

![]()

Multi-rail mobile platform

Multi-rail mobile platform New faster payments opportunities

New faster payments opportunities Aids the FedNow® Service and RTP

Aids the FedNow® Service and RTP Processes transactions in minutes

Processes transactions in minutes

![]()

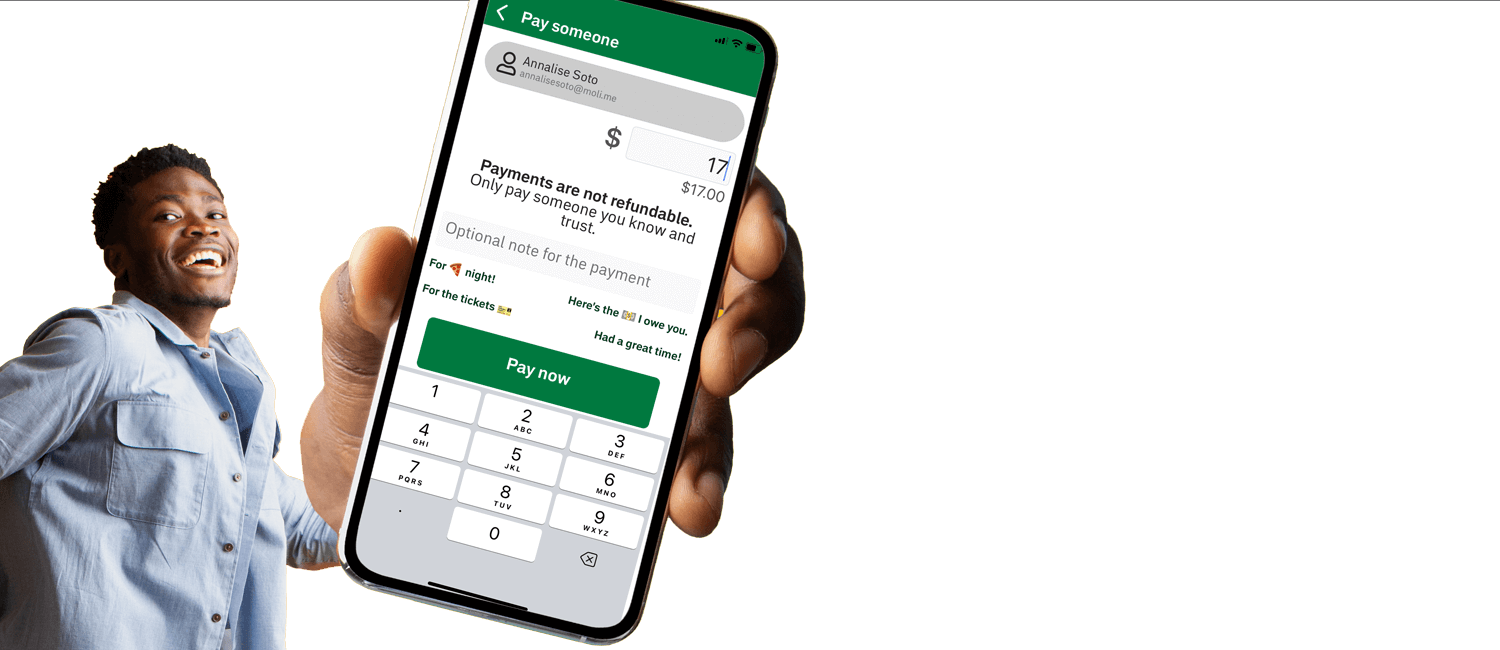

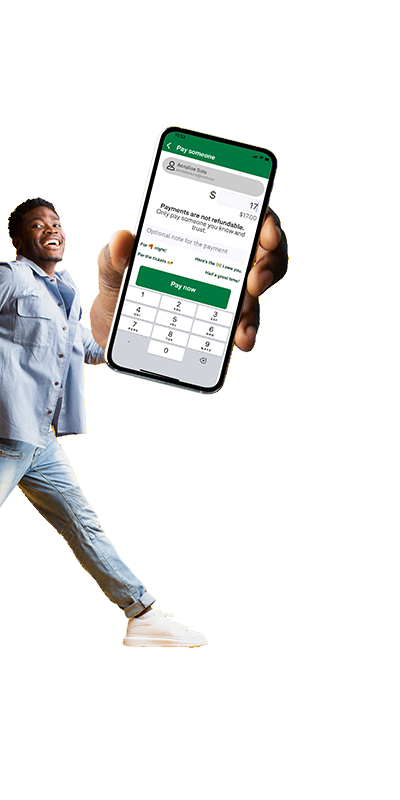

What is Moli?

![]()

![]()

The safe, fast, and turnkey mobile payments platform designed specifically for banks and credit unions allowing FIs to offer their clients a new way to send money to friends, family, and anyone else, from a mobile device.

With same-day ACH, Aptys delivers an innovative SaaS platform making onboarding a breeze for your FI. With fast, faster, and

faster-er P2P payment options, Moli removes limitations for FIs giving them the option to offer customers access to the latest in mobile payment innovation and technology that prepares them for future capabilities.

![]()

Open the door to new opportunities by offering real-time mobile payment solutions

![]()

With Moli, your financial institution can deliver lightning-quick P2P transactions safely and conveniently so you can compete with any financial institution offering functionality without sacrificing the quality of service your clients depend on.

![]()

The Benefits of Implementing Moli

![]()

Faster, more convenient payments for your customers

Omni-rail, cloud-native, consumer and commercial payment solutions for P2P, A2A, and other use cases

Gives your client the option to connect to Moli using a checking account

Capabilities for RTP and the FedNow℠ Service (available soon)

Fast, Faster, Faster-er and ultimately more convenient payments for your customers enabling you to provide Moli Moments in their lives

Transactions that clear in minutes

Moli Moments that connect your clients to your FI

Simple and easy onboarding for everyone

FI logo in-app links your customers with their trusted financial services provider

Integration with existing payment channels

Compete and Win in Today’s Digital First Environment

Opening the door to new opportunities in faster payments

![]()

Applying Moli to your operations

![]()

How we can help overcome common financial challenges

The challenge:

Since the pandemic, mobile P2P solutions have grown exponentially. In fact, the market demand grew much faster than the industry could respond. That’s why most options... Read More

The results:

With research indicating that by 2026, more than $2.2 trillion will transact via mobile P2P apps, Aptys understands the importance of providing banks, credit unions,... Read More

1. Brings a competitive solution to the FI, and

2. Creates the infrastructure banks and credit unions need for future, faster payment opportunities (generating a substantial market opportunity)

-

“The benefits of Aptys’ multi-channel payments platform, PayLOGICS are extensive. Through PayLOGICS Alloya offers key functionalities including image cash letter, ACH, Fed wire, international wire origination, and Fed messages —simplifying cash management, settlement and reconciliation by seamlessly combining real-time payments with a member credit union’s existing settlement account supports our goal of providing value-added settlement services for our member credit unions. ”

— Todd Adams, President of Alloya Corporate Federal Credit Union

-

“Strategically, we needed to prepare for the future by simplifying our payment systems and aggregating our payment data into a single platform. Through Aptys’ multi-channel payments platform, PayLOGICS, our data has been consolidated from seven systems into one and has made risk, compliance and vendor management easier and faster. Aptys has given us the opportunity to be able to quickly and efficiently extend real-time payment capabilities from RTP or FedNow to our members. ”

— Jeff Stoner, Chief Technology and Strategy Officer of Vizo Financial Corporate Credit Union

-

“It makes sense to work with a partner like Aptys that understands our faster payments needs and has a successful track record in payments to successfully deliver the tools that we need for our customers.”

— Bankers’ Bank of the West SVP & Chief Operating Officer, Jeff Benson

-

“Aptys is a partner, not a vendor, and the company understands what customers need. Partnering with Aptys was an easy choice. It’s solutions better serve our community bank customers by providing a fully automated, seamless payment processing experience.”

— Craig Howie, president of Atlantic Community Bankers Bank

-

“Through Catalyst Corporate and Moli, credit unions have easy, cost-effective access to innovative faster payment services with near-real-time capabilities.

— Bruce Fox, President and CEO, Catalyst Corporate FCU

![]()

The latest update

![]()

Glendale Area Schools Credit Union Is Now Live with Aptys’ Real-Time Payments via FedNow® Service

Glendale Area Schools Credit Union Is Now Live with Aptys’ Real-Time Payments via FedNow® Service

Read more

![]()

Come on, Let’s Moli

![]()